.

7/15/13, "Retail Sales Disappoint in June," Reuters

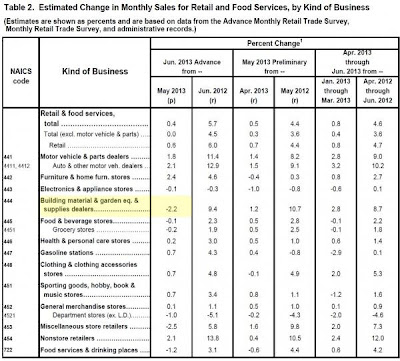

"The Commerce Department said on Monday retail sales increased 0.4

percent last month as demand for automobiles soared. However, sales of

building materials fell....

Economists polled by Reuters had forecast retail sales, which account

for about 30 percent of consumer spending, rising 0.8 percent after a

previously reported 0.6 percent gain in May....

It was still the third straight month of gains in sales and followed a revised 0.5 percent rise in May."...

----------------------------------------------

7/15/13, "Retail Sales Slide, Miss: Biggest Drop And Miss In 12 Months," Zero Hedge

"If the worst retail sales number in 12 months doesn't send the S&P

to 1,700 nothing will. Because that is precisely the data point we got

moments ago when the Census bureau reported June retail sales growth of

0.4%, missing expectations of a 0.8% print and down from a downward

revised 0.5%. However, the only growth in the headline number was thanks

to auto and gas sales. Ex autos retail sales were unchanged on

expectations of a 0.5% increase, while ex autos and gas the

print was down -0.1%, crushing hopes of a +0.4% increase. Any minute

now, however, the Fed's S&P500 trickle down will, with a 4 year

delay, hit the end consumer: the entire Princeton economics department pinky swears.

Ironically for the housing recovery had a bit of a sputter, with

Building Material and related retail sales dropping 2.2% on an adjusted

basis in June

(and crashing Unadjusted but who cares about real,

unfudged data):"...

chart from Zero Hedge

.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment