.

7/13/12, "Constricting supply obviously will push prices higher."

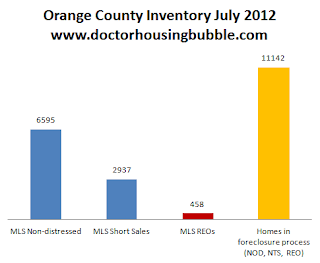

Above Orange County, Calif. housing chart, yellow bar=large shadow inventory in foreclosure process as of July 2012, via doctorhousingbubble

7/13/12, "The making of a housing market – like a Hollywood set, housing inventory looks to be low only because that is what is being presented," Zero Hedge, by doctorhousingbubble

"Orange County is seeing a solid jump in sales this year. We have seen a good amount of short sales hit the market recently. If we look at MLS inventory and last month sales we have approximately two months of inventory! This is back to the days of the mania. Yet this is only part of the story. Take a look at the total Orange County market (chart above).

Short sales are a big part of the visible MLS inventory making up roughly 30 percent of all inventory. Look at how tiny the REO listings are. But take a look at the yellow foreclosure pipeline. These are homes in the foreclosure process. This figure is nearly twice the size of the non-distressed visible inventory. These are households unable (or unwilling) to pay their mortgages in an expensive county. Does that seem healthy to you? Just because banks are selectively leaking out inventory does not mean the market is healthy.

It is an interesting observation on human behavior when you examine the thought process of those buying.

“Banks can do whatever they want and I need a home to start a family.”

“These record low interest rates are making it tempting to buy.”

It is fascinating that many do thoroughly understand what is occurring. That is, the market is like a Hollywood set and is fake. It is a façade yet the financial system that proclaims “free market” capitalism all the way through is more than willing to let a command-control housing market take place. The irony of this all is that many of the programs holding up the market (i.e., FHA insured loans, GSEs MBS, etc) at their core are set to keep housing affordable for Americans....

In spite of home prices moving up and visible inventory going down, foreclosure filings are still occurring at an elevated level.

These are fresh filings entering the pipeline. These are filings that will go to the yellow column above. The good news is that year-over-year the number of filings has declined substantially. This is a positive for the market. At this rate we are years away from any semblance of a normal market.

What needs to be taken into context as well is the desire to modify loans and also, the jump in short sales. Banks seem to be willing to agree to short sales (if a place like Orange County has 30 percent of visible MLS inventory as short sales this is definitely a strategy that is being pursued). Short sales by definition will likely push prices lower in metrics like the Case-Shiller that look at repeat home sale.

Nationwide inventory

The trend of lower inventory is occurring on a nationwide basis.

Inventory is back to levels last seen in 2005. The strategy of leaking out inventory in a controlled fashion while leveraging low mortgage rates seems to be the ongoing plan. If you speak with many investors in the trenches their investment strategy really is dependent on the moves the banks and government make. If you truly looked at the market as being transparent and open, you would likely jump in with both hands since visible supply is low and demand is still there. Yet you are contenting with a multitude of other factors:

-If the market is healthy, why are we seeing a large number of short sales?

-If supply is so low and demand is here, why are banks restricting inventory?

Bottom line, banks are trying to maximize profits via re-writing accounting rules and using massive government bailouts to their benefit. Short sales do better than foreclosures. Constricting supply obviously will push prices higher. The Fed owns trillions of dollars in MBS and we are left with a record low mortgage rate. The market is looking for lower priced housing while the financial system is determined to do everything to keep prices inflated. Financial scandals are hitting left and right and no solid reform are ushered forward."...

=================================

7/4/12, "Keith Jurow: House prices in New England crashing," ochousingnews.com

"The amend-extend-pretend policy of America’s banks is most pronounced in New England, particularly New York where the lenders live. There have been very few foreclosures despite high default rates, partly because the judicial foreclosure process in these states is log-jammed, and partly because lenders don’t want to foreclose and recognize their losses. Of course, this policy has prompted a great deal of strategic default among loan owners who recognize they can live for free, but it has succeeded in making everyone else believe their neighborhoods are somehow immune to the housing bust, at least until the last year when prices because to fall precipitously....

One of the most astounding revelations that came from his research is how much larger the shadow inventory is than is widely reported. Lenders don’t have to file a Notice of Default when a borrower becomes delinquent on their payments. They have the right to do so, and prior to the housing bust, they always did as quickly as possible to begin the foreclosure proceedings and get their money back.

However, as the housing bust worsened, lenders began delaying their NOD filings because they already had more than they wanted to process because the foreclosures were hurting house prices. The borrowers who were delinquent but not yet served notice became shadow inventory.

CoreLogic is the most widely reported measure of shadow inventory, but they rely on lenders to voluntarily report their delinquencies. Lenders are under no obligation to report, and no obligation to tell the truth if they do. However, the State of New York requires lenders to notify the state and the borrower when they become delinquent that they may be subject to a foreclosure. It’s like a pre-notice prior to the actual Notice of Default. In New York, the shadow inventory is visible to those who know where to look for it. These numbers used to be published, but for some unknown reason (likely industry pressure), these numbers have not been published for quite some time. The data is public information, and Keith Jurow found the bureaucrat responsible for tallying this information and obtained it. The numbers in New York are astonishingly large. Keith’s outlook on prices in New England is rightfully bleak."...

------------------------------------------------

Above via commenter on doctorhousingbubble.com

"Lord Blankfein

What?, I agree home prices are fucked up here in California. However, this will be a picnic compared to what is happening in the NYC metro area. See attached link with presentation from Keith Jurow. If there is anyway to short the NYC real estate market, let me know.

http://ochousingnews.com/news/house-prices-in-new-england-crashing

The market in California will be in shambles for years to come. Yes, there is currently a frenzy but I would bet this is just another head fake. The fundamentals all point to more downward pressure. It’s frustrating to be a potential buyer right now, but you’ll likely be able to buy the same house a few years down the road for the same amount or less."