.

Nov. 17, 2020, “Hundreds of Companies That Got Stimulus Aid Have Failed,” Wall St. Journal, by Shane Shifflett

“Recipients of PPP loans have filed for bankruptcy after the money ran out.”…

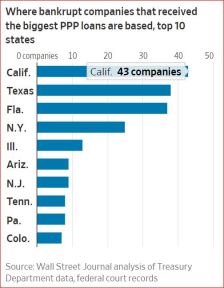

“About 300 companies that received as much as half a billion dollars in pandemic-related government loans have filed for bankruptcy, according to a Wall Street Journal analysis of government data and court filings.

“About 300 companies that received as much as half a billion dollars in pandemic-related government loans have filed for bankruptcy, according to a Wall Street Journal analysis of government data and court filings.

Many of the companies, which employ a total of about 23,400 workers, say the funds from the Paycheck Protection Program weren’t enough to keep them going as the coronavirus and lack of additional stimulus payments weighed on their businesses.

Many of the companies, which employ a total of about 23,400 workers, say the funds from the Paycheck Protection Program weren’t enough to keep them going as the coronavirus and lack of additional stimulus payments weighed on their businesses.

The total number of companies that failed despite getting PPP loans is likely far higher. The Journal only analyzed the big borrowers from the program, which accounted for about half of the overall loans though only about 13.5% of the total participants. And many small businesses simply liquidate when they run out of cash rather than file for bankruptcy.…

There is growing evidence that the government’s policy of lending money with few questions asked has allowed fraud and abuse among borrowers, according to the SBA’s inspector general. The government also didn’t focus on the risk of bankruptcy for the companies getting loans as it sought to quickly get cash to workers hit by coronavirus shutdowns. The loans were guaranteed by the SBA as long as the money was spent on qualifying expenses such as payroll, so the government will likely suffer significant losses.

There is growing evidence that the government’s policy of lending money with few questions asked has allowed fraud and abuse among borrowers, according to the SBA’s inspector general. The government also didn’t focus on the risk of bankruptcy for the companies getting loans as it sought to quickly get cash to workers hit by coronavirus shutdowns. The loans were guaranteed by the SBA as long as the money was spent on qualifying expenses such as payroll, so the government will likely suffer significant losses.

Most small businesses in bankruptcy don’t have enough cash to fully repay creditors, according to Thomas J. Salerno, a partner with Stinson LLP in Phoenix. “That loan is going to be a general unsecured claim,” he said. “If [unsecured creditors] get 5 cents on the dollar, that’s what the SBA gets.”…

Keith Clark ran Waterford Receptions, a popular wedding and events venue operator with two locations in Northern Virginia, for 20 years. He is closing for good, losing his business as well as his house because of the pandemic.

“It hit, we had to shut down, and cash-wise it couldn’t have been worse timing,” Mr. Clark said….

Mr. Clark used a $500,000 PPP loan awarded in April to pay 45 salaried employees over the summer while Waterford’s two buildings remained largely unused because of a statewide ban on large gatherings, he said. Waterford hosted a handful of small outdoor events for 20 or fewer masked individuals while waiting for a chance to fully reopen, he said.

Revenue this year fell to $567,000, down 90% from $6 million in 2019, according to court documents. Mr. Clark considered filing for chapter 11 bankruptcy under the Small Business Reorganization Act, which makes it more advantageous for firms to quickly restructure operations and shed debt, but...it became harder to envision a reopening.

“In order to reorganize and keep going, you have to say when we’re going to be open,” he said. “We had plenty of bookings but no foreseeable date where we could get going again.”…

Because he personally guaranteed a $1.5 million loan from the Small Business Administration last year, Mr. Clark, 68, expects to file for personal bankruptcy and auction off his home to pay creditors….

“We all blame President Trump for his dereliction of duty; we would have been able to stay in business if he had done his job,” Mr. Clark said. “I hope that Congress and [President-elect Joe] Biden will work together in a sane manner to help Americans in these situations.””…images from Wall St. Journal

…………………………………

Among comments

…………………………………..

…………………………………

“Steve Kissee

This was a self induced financial downturn of [alleged] necessity that was ordered by governing bodies. Those same governing bodies should be held to keep these businesses afloat. This has nothing to do with “structural’ changes in the economy. This is all temporary (except for the super minority that will die with a mask on their face 10/20 years from now). The one lesson that will hopefully be learned from this is the necessity by all businesses to maintain strategic capital reserves, not just the banks. I am super saddened by all these businesses that have fallen victim to this after their many years of efforts to become successful.”…

…………………………

“Gerard Guerra

The PPP loans were no guarantee of success, just a way to keep their employees employed that were not yet fired for a short period of time – if they were struggling before COVID most likely they weren’t going to last.”

………………………………..

“Maria Patterson…

“I just wish the administration and Congress hadn’t lent guys like Clark money in the first place when our [Virginia] governor was ensuring many would fail. I’m also sorry the rest of us will now have to pay for what the Virginia governor caused to happen to Federal money!

No Mr. Clark, it was our wonderful pediatrician doctor [Virginia] governor...that caused your pain.

Northam shut down the state’s economy, and applied a one size fits all solution lacking in common sense or considering the needs of small business owners like you.”

…………………………………………..

My comment: It must be euphoric for “the governors.” Being encouraged as a select group, given a blank check of endless billions of US tax dollars to commit legal genocide of millions of defenseless American families–doesn’t happen often. And this is special, the slow strangulation variety of genocide that you can watch.

Wow! It’s not like everyone drinks Kool Aid and dies at once. No, the governors get to watch as children are deprived of sufficient sunlight needed to grow strong bones. Governors are key players in the greatest crime against humanity in history. Of course, most of the credit goes to Trump. It was Trump alone,

Wow! It’s not like everyone drinks Kool Aid and dies at once. No, the governors get to watch as children are deprived of sufficient sunlight needed to grow strong bones. Governors are key players in the greatest crime against humanity in history. Of course, most of the credit goes to Trump. It was Trump alone,

“15 days to slow the spread,” “30 days to slow the spread,” etc., who insisted the US act on an unverified computer model of a math professor in a small country thousands of miles from the US. Sir Neil Ferguson is so beloved by the Queen for his faulty computer models that she awarded him an OBE [Order of the British Empire, Honorary Knight of the British Empire] “for his work on the 2001 UK foot and mouth disease epidemic. Prof Ferguson advises the UK and US governments,” Ferguson’s computer model called for slaughter of millions of healthy and beloved animals belonging to ordinary citizens. This time, we’re the cattle.

Above, 4/12/20, “The full horrifying scale of the 2001 foot and mouth outbreak told by the Welsh farmers in the middle of it,“ walesonline.co.uk, Anna Lewis…Neil Ferguson’s 2001 computer models said the only option was slaughter. The British establishment had its mind set on mass slaughter of millions of healthy animals.…“Lest We Forget,” John Brignell, 2004

Computer models have become a substitute for science--which takes much longer and costs much more:

“Lest We Forget,” 2004, John Brignell, numberwatch.co.uk

“It is relevant at this point to comment on the touching faith that politicians and the media have in computer models. It

is generally true to say that most large computer models are not worth

the magnetic oxide they are written on, and I say that as one who has

been computer modelling for well over 40 years.”…………..

...................

No comments:

Post a Comment